Homeowners!

We just finished our closing, and we are officially homeowners!

I feel relief, freedom, and pride.

More details later.

The story of my bankruptcy, so that you might make a more informed decision about what's the right choice for you.

We just finished our closing, and we are officially homeowners!

I feel relief, freedom, and pride.

More details later.

Just a very quick, very brief update:

Today we received clearance to close on our home loan, and the closing has been scheduled for MONDAY. Just five days away from becoming homeowners, and in less than one month after first contacting Quicken Loans. They worked so much faster than Union Savings Bank, whom I have become convinced was just trying to stall us.

More info on the closing and our new home-ownership soon.

Just a quick update on the home mortgage.

Just a quick update on the home mortgage.

After returning home from vacation and contacting several new lenders, starting over with the home mortgage process completely, things are progressing quite nicely. Our appraisal came in today perfectly in line with the purchase price of our home -- that was one of our biggest concerns. We've been approved and have an anticipated closing date of October 5.

It's a good feeling to be this close to finally owning our own home.

The experience with Quicken Loans has been rather pleasant so far. They work fast, seem to be quite thorough, and everything has gone amazingly smoothly (knock on wood).

Stay tuned for future updates.

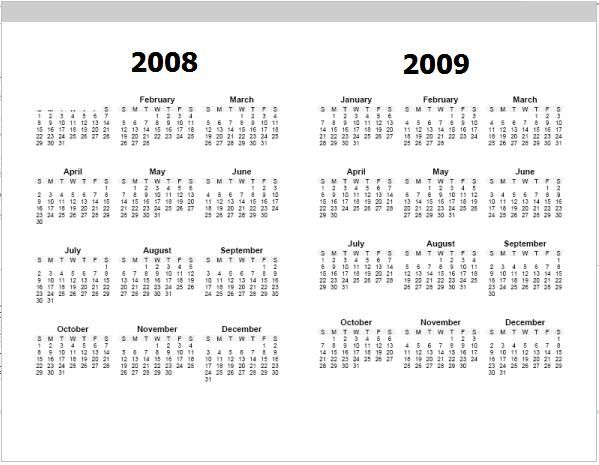

In June, I contacted the same banker that I spoke with initially last December. It was two months before our Bankruptcy was due to mature to two years, but he had indicated that we might be able to be prepared for a closing date that would coincide with the maturity date if we started in June.

In June, I contacted the same banker that I spoke with initially last December. It was two months before our Bankruptcy was due to mature to two years, but he had indicated that we might be able to be prepared for a closing date that would coincide with the maturity date if we started in June.

It has become obvious over the past three months that he was stalling, as he continually sprung upon me hurdler after hurdle that dragged the process out. It was just before our recent family vacation that I decided to drop the process and resume after our vacation with a different lender.

Since returning from vacation, I contacted three lenders, including Chase, Fifth Third, the Lending Tree, and Quicken Loans.

The Lending Tree was no help. The representative from Chase Bank that contacted me was rude and pushy, insisting that I tell him what other lenders were trying to do for me so that he could show me how he could serve me better. He refused to present me with a Good Faith Estimate so that I could make the comparison on my own.

Fifth Third Bank, where we bank (though they didn't know that) contacted me only by email.

Quicken Loans was the fastest to respond, the most eager to serve me, and the most professional I have dealt with of the four. I am happy to say that our loan is currently being reviewed by an Underwriter, and we hope to have a closing date the first week of October.

That bank that I was working with originally? Union Savings Bank. We're back at square one now, but things look more promising than ever.

It has been two years today since our bankruptcy was discharged. With this momentous event comes many more opportunities for the financing of our home. More details in the week to come.

Being debt free is a wonderful feeling....

Question: "How can I trust God when I am facing unemployment, foreclosure, or bankruptcy?" Answer: The loss of employment and/or income is one of the most distressing events in life, especially for those supporting a family. Foreclosure on the family home or having to declare bankruptcy due to unemployment adds additional fear, uncertainty, and emotional turmoil. For the Christian man or woman facing unemployment, foreclosure or bankruptcy, there can be additional doubts about God’s goodness and His promises to provide for His children. How is the Christian to react to these catastrophic life events? What biblical principles can we apply to the loss of a home or a job and benefits (health/life insurance, retirement)? First, it’s important to understand that God has ordained work for mankind. Work is described in the Bible as beneficial in that it provides for our needs (Proverbs 14:23; Ecclesiastes 2:24, 3:13, 5:18-19) and gives us the resources to share with others in need (Ephesians 4:28). Paul reminded the believers in Thessalonica that anyone who was not willing to work should not eat (2 Thessalonians 3:10) and that he himself worked at tent making so as not to be a burden on anyone (Acts 18:3; 2 Corinthians 11:9). So loss of employment should not be an excuse for laziness, and all due diligence should be exercised to find other employment as quickly as possible (Proverbs 6:9-11). At the same time, it may not be possible to find a position equal in pay and status to the one that was lost. In these cases, Christians should not allow pride to keep them from taking jobs in other fields, even if it means lowered status or less pay, at least temporarily. We should also be willing to accept help from other believers and our churches, perhaps in exchange for work that needs to be done in homes, yards, and church facilities. Extending and accepting a ‘helping hand’ in these times is a blessing to those who give and to those who receive and exhibits the ‘law of Christ’ which is love for one another (Galatians 6:2; John 13:34). Similarly, loss of the family home through foreclosure or bankruptcy can even be a time of blessing for the family, a time when parents and children “close ranks” and become more keenly aware of their love for one another and the important things in life—faith, family and community—and less focused on material things that have no eternal value and can disappear in a moment. God can also use these circumstances to remind us of the truth spoken by Jesus in Matthew 6:19-20, and refocus our hearts on heavenly treasure. Above all, renewing our faith and trust in God’s promises is of utmost importance during times of financial stress. Revisiting passages that speak of God’s faithfulness to His children will strengthen and encourage us when the future looks bleak. First Corinthians 10:13 reminds us that God is faithful and will not test us beyond our ability to bear it and will provide a way out of the trial. This ‘way out’ may mean a new and better job that comes up right away. It may also mean a lengthy period of unemployment during which God’s faithfulness in providing our daily bread is shown to us. It may mean a new home or it may mean living in reduced circumstances with relatives for a period of time. In each case, the way out is really the ‘way through’ the trial, in which we learn of God’s faithful provision as He walks by our side through the entire ordeal. When the time of testing is over, our faith will be strengthened and we will be able to strengthen others by bearing strong testimony to the faithfulness of our God. Recommended Resource: When God Doesn't Make Sense by James Dobson.

|

In my last post, I mentioned that we would be considering our home mortgage through a different lender because the first lender we spoke to had sprung additional costs and restrictions on us nearly 45 days into the process. Well, there is news.

First, after speaking with the second lender on the phone, explaining the situation (including the fact that our bankruptcy would mature to two years on August 4), and providing the necessary information for the credit reports to be run, I heard nothing back from the lender. I made several attempts to call this lender (and because my goal here is to help others going through bankruptcy, I'll share with you here that this secondary lender was Fifth Third Bank), with no response. Finally, I called a toll free home mortgage hotline they list on their website and learned that 5/3 Bank uses only an automated underwriting system, which would automatically reject our application if we apply before the bankruptcy is two years old. Which put that idea on the back burner for another few weeks.

Second, the lender we've been working with contacted me about having an appraiser come out to the house to assess it's value, and he was willing to do so without having yet received the application fee, so I agreed. The appraiser came out on Friday morning and was here for less than half an hour. He took some pictures -- inside and out -- and asked some questions, then left. There were two things he was asked to determine, and I got the news early Friday afternoon.