One Year and Counting

Where have I been over the past six months? Wow, has it really been that long since my last post? Yes, I guess it has. It has blown by quite quickly.

Where have I been over the past six months? Wow, has it really been that long since my last post? Yes, I guess it has. It has blown by quite quickly.

Life on the post-bankruptcy front has been going along well. We are still essentially debt-free. We have just one credit card, which we use occasionally and pay off every month (which, of course, is the only way that a credit card should be used). Our cars are both paid for (we have resisted the wishes to have new cars because our desire to have no car payment is stronger), and our only real debt is our home loan. Life is good.

Since filing for bankruptcy, we have moved into our new home and even begun tithing to our church. Our new house payment is more than twice what we were paying for rent before we moved. But getting our debt relieved and moving closer to work has so greatly reduced my commuting expenses (the price of gasoline being so high) that we have been able to add tithing to our monthly budget and barely notice the impact (financially, that is). Of course, I believe that tithing has also brought God's blessings upon us and made us better stewards of the money we have left.

We have had money in our savings account for the past six months, and haven't been living from paycheck to paycheck as we did so frequently pre-bankruptcy. Having opted out of pre-screened credit card offers, we have eliminated the potential credit trap that so many newly debt-free people find themselves in. We simply don't receive the offers, so we don't have to resist the temptation to respond to them.

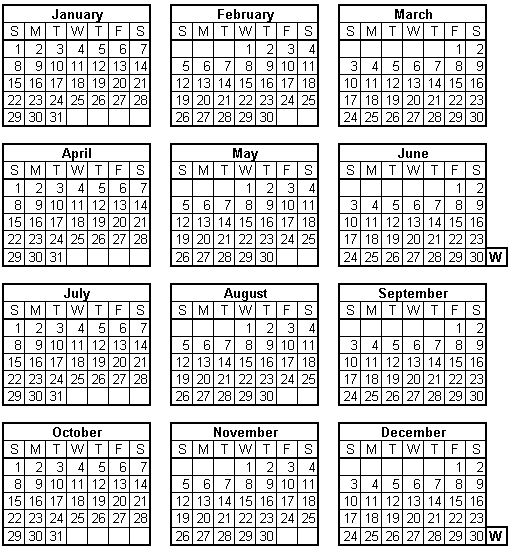

We just hit the one-year anniversary of our discharge date two days ago, and it is a wonderful feeling to still be so fully in control of our finances. It is truly a liberating feeling.

That is not to say that there won't still be an occasional challenge to your debt-free status so long after discharge. Just two weeks ago we received a mailing from a creditor demanding payment of a debt that was discharged as part of our filing. The nicest part of it is, a simple phone call to notify them that the debt was discharged was all it took to end the notices.

The birthday season for our family is now fully in swing, with Christmas following closely behind it. This can be a very tempting time to resort to credit cards and other offers to purchase gifts now and pay for them later. I have just one word of advice that has become my mantra in the world of credit:

For those who you still struggling with the decision to file for bankruptcy, it has not been a bad experience at all. You have to first understand that the option of bankruptcy is there because creditors tend to take advantage of consumers, and we need to have an alternative to being buried in debt. The reason for making the bankruptcy laws so much more prohibitive was to prevent abuse by repeat filers, not to prevent legitimate first time filings. It is not really a difficult process at all, and the past year has been nothing but a positive experience.

I am no financial expert. I am just one man who has been there, but I am more than willing to share my experience with you and to answer any questions that you might have. Just leave your questions in the comments, and I will answer them in the comments.